How to Use Data to Prove Amazon Owes You Money

The

Problem

Around 2.5% of your revenue might be going out the window

Amazon charges a variety of fees for selling on its platform. For example, CoOps/Accruals or chargebacks for non-compliance with their policies. But Amazon makes mistakes, and they don’t track their own errors for you.

Meanwhile, it’s essentially impossible for 1P and 3P sellers to audit these fees themselves because of the amount of manual effort that would be involved.

Trust us, you don’t want to do this yourself. But you also don’t want to leave money on the table.

One way to audit fees is to download numerous reports from Amazon. Vendor Central and Seller Central offer a number of reports that can be used to find fees, when they were charged, what they were for, and where they are deducted.

Reports in Seller Central highlight expenses and net proceeds, while Vendor Central includes similar information with a greater emphasis on chargebacks and compliance.

Portal-specific examples of reports associated with accounts receivable and deductions from payment.

Financial Dashboard: Dashboard display of all financial data including receivables, payables, adjustments, and account balance.

Remittance Report: A comprehensive breakdown of all financial activity within a given period. Includes information on sales, fees, deductions, promotions, and adjustments.

CoOp Deductions: Detailed reporting on all accrual, coop, and straight payments deducted from accounts recievable.

Deduction Detail Report: Specifically focuses on deductions applied to your account. It provides a detailed list of deductions, including chargebacks, returns, allowances, and any other deductions made from payments.

Operational Performance: Compliance for reasons such as PO on time accuracy, ship in own container, prep issues, and carton content accuracy.

Payables Report: Aggregated amount of all deductions Amazon will take against your invoices, returns, chargebacks, and contra COGS

Transaction Summary Report: displays the account transactions within a statement period, up until the prior day’s close.

Statement Summary: summarizes your payment information which shows your current total balance, available funds, and recent payouts across all account types.

Sales Tax Reporting: detail buyer paid sales tax amounts shown in your order details, payments, and financial reports.

Disbursement Tracker: shows the amount paid out in each settlement period to your account and the status of your funds.

Advertising Invoicing: displays the total amount owed at the end of the billing cycle or closing date. This balance includes all unpaid and outstanding charges on your account.

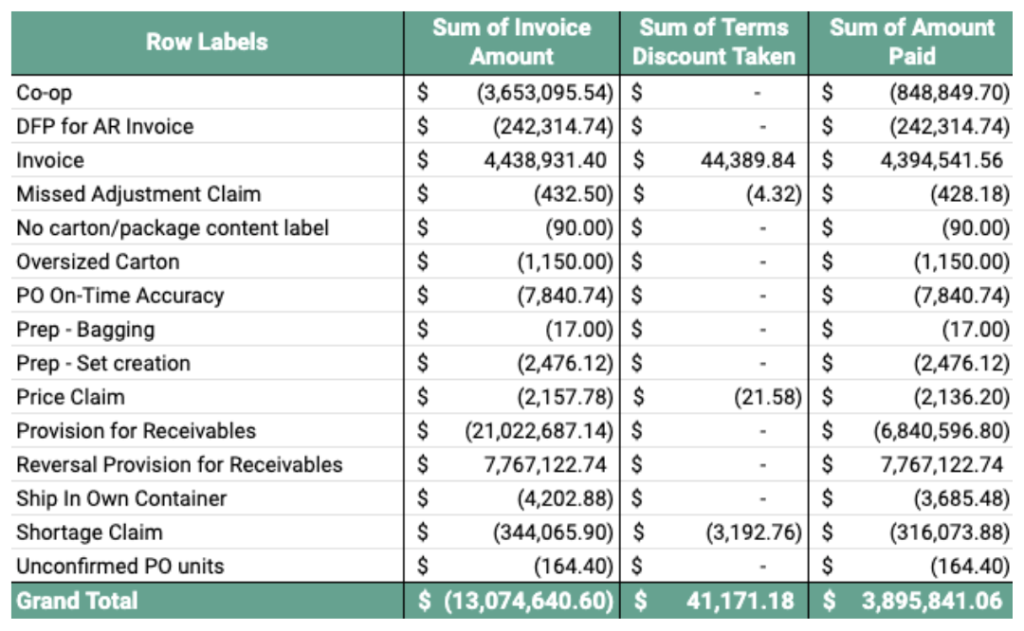

Another way to find recoverable chargeback fees is to use pivot tables in a tool like Excel. Pivot tables can be used to summarize large amounts of data, making it easier to identify patterns and anomalies. For example, you could create a pivot table to reconcile total purchase order volume against payment terms, chargebacks, marketing spend, and other deductions.

Note: summarizing data with pivot tables is more useful for 1P vendors than 3P sellers, who are better served analyzing item-level profitability by comparing sales with all possible costs

Finally, you can create and monitor case logs. Case logs can track all of your interactions with Amazon, including any disputes you’ve had about fees. This can be helpful if you need to dispute a fee in the future. When creating a case log, be sure to include the following information:

We can give you that chance. Within two weeks we can find your recoverable chargeback fees…and you pay nothing upfront – we’ll simply charge a portion of your savings.

We will use our system to:

Our clients – sellers, vendors, and agencies grossing around $50-200MM a year – earn back between 1% and 4% of their revenue through this process.

Copyright © 2023 Equity Commerce. All Rights Reserved.