Designing an ecommerce website has never been easier. In fact, thanks to the rise of software-as-a-service (SaaS) ecommerce providers – like Shopify, WooCommerce, BigCommerce, and others – the once-laborious process to create an online store now involves just a few clicks of a mouse.

However, it’s after your new site launches that the real challenge of attracting customers and getting your storefront noticed truly begins. According to the US Small Business Administration, more than 627,000 new businesses are started each year, which means that each month, more than 52,000 new potential competitors are out there, ready and willing to take attention away from your new store.

That’s why new and existing customers must trust your brand and have the confidence to make purchases on your site. As an ecommerce business owner, you have a full arsenal of digital marketing tools designed to help you. Here are a few ecommerce homepage best practices you can use to get started.

How to Get Your Ecommerce Site Noticed: 5 Ecommerce Website Design Best Practices

If you’re looking to maximize the effectiveness of your branding and boost conversions on your website, keep in mind five online store best practices for e-commerce website design throughout the site-building process.

1. Showcase Reviews on Your Ecommerce Storefront

An ecommerce site’s lifeblood is its customer reviews, so be sure to collect, curate, and share, share, share those ratings on your website in a prominent place – like your storefront ecommerce home page.

Providing examples of positive reviews and favorable product ratings from previous consumers helps potential customers not only decide between product options but also feel confident about purchasing. This social proof can help to convert a browsing customer into a purchasing customer.

2. Create High-Quality Content

Build and strengthen customer trust by creating high-quality product page content. Ensure that every page on your website contributes to the cause. This means each page communicates clearly and precisely with fresh images, anticipates questions, and accurately and adequately describes the products for sale.

3. Provide Multiple Payment Options

Provide multiple payment options to ensure a smooth and easy checkout. Once a customer has found that perfect product, are they able to buy from you with their preferred payment method? While some customers will use a debit or credit card, others may prefer a payment service that keeps funds in escrow until the ordered item is received. Options are important!

4. Prioritize Customer Services and Quick Fulfillment

Great customer service and quick fulfillment are must-haves. Ensure that your online business includes a customer service team that can answer questions and queries quickly and clearly. Customers love good service and, in many cases, they’re even willing to pay higher prices to get that top level of service.

Quick shipping matters, too. In fact, more than 70% of shoppers expect to receive their items within two days of purchase. The days of “allow 4-6 weeks for delivery” are long gone – your customers expect near-instant gratification, so it’s critical you can match those expectations.

5. Simplify the Purchasing Process on All Digital Storefronts

Count the number of clicks it takes to complete a purchase. When designing your digital storefront, keep in mind that it should be easy for consumers to complete a purchase with just two clicks of the mouse (or less) to get to checkout. Any additional clicks will negatively impact conversion rates and you risk customers leaving your site or clicking away before making a purchase.

How Amazon’s Buy With Prime Program Can Help With Ecommerce Site Best Practices

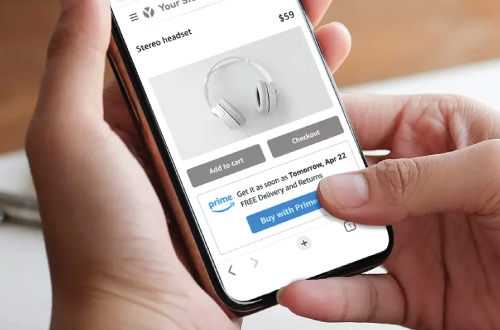

The above web design tips for ecommerce storefronts will help, but there’s another tool you should take advantage of: Amazon’s Buy with Prime service. If it’s crystal clear to customers that your online store leverages the Buy with Prime service on your homepage, you’ll provide new consumers with additional trust factors that can lead to conversions.

Not only does Buy with Prime provide an additional check-out option (as noted in our list above), but store owners can also leverage Prime’s compelling 1-2-day shipping promise and Amazon customer service!

Buy with Prime also provides merchants access to Amazon Pay, another well-known and highly trusted payment option that your customers can rely on when completing a purchase.

According to Amazon’s data, more than 50% of non-Prime transactions fail because consumers are unwilling to pay high shipping costs. Prime members (now more than 200 million worldwide!) also expect 1-2 day delivery service, so just by offering Buy with Prime on your site, you can differentiate your brand. And best of all, brands that already leverage Fulfillment by Amazon (FBA) can quickly add the power of Buy with Prime to their Amazon businesses.

While competition is heating up and more businesses are launched every month, savvy business owners who focus on continuous improvement in a dynamic marketplace like Amazon now have a powerful opportunity to truly unleash the power of Amazon’s tools to grow their businesses off of Amazon.

Want to learn more about how to use Buy with Prime and leverage Amazon’s advertising platform to grow your business? Check out our guide, “How Marketplace-Native Brands Can (and Should) Leverage Buy With Prime.”

Welcome to Part 2. In the

Welcome to Part 2. In the  This requires nimble teams on the brand side that understand the need and often the urgency, for aggressive product pricing to move products out of facilities.

This requires nimble teams on the brand side that understand the need and often the urgency, for aggressive product pricing to move products out of facilities. A third storm element (and one with even bigger waves) creating challenges for sellers is the status of warehouse space at Amazon fulfillment centers for brands leveraging Fulfillment by Amazon (FBA). Running lean is the answer. In fact, if products are sold via FBA – the goal should be to turn that inventory before 60-90 days. The longer items remain in FBA warehouses, the larger the costs of storage in addition to sunk costs of business capital that cannot be accessed until the items are sold.

A third storm element (and one with even bigger waves) creating challenges for sellers is the status of warehouse space at Amazon fulfillment centers for brands leveraging Fulfillment by Amazon (FBA). Running lean is the answer. In fact, if products are sold via FBA – the goal should be to turn that inventory before 60-90 days. The longer items remain in FBA warehouses, the larger the costs of storage in addition to sunk costs of business capital that cannot be accessed until the items are sold.  If you feel the need for an experienced sailor – the team at

If you feel the need for an experienced sailor – the team at

apparent that Amazon wants to share (if not

apparent that Amazon wants to share (if not  building an online catalog and Bezos and team were able to quickly create

building an online catalog and Bezos and team were able to quickly create

No secrets here, but Amazon has invested heavily. First in its logistics and warehouse network (aka “the moat”) and more recently in its advertising capabilities. The company is famous for solving internal problems first and then offering these same services to outside third parties to generate additional revenues. Think about Amazon Web Services or AWS – and how Amazon created it internally and oh by the way, essentially invented a new type of business based on selling cloud infrastructure. Amazon is in an enviable and unique position in that it can offer access to other businesses to leverage its logistics network and advertising solutions. Oh and the cherry on top? This also negatively impacts rivals such as Shopify and Google.

No secrets here, but Amazon has invested heavily. First in its logistics and warehouse network (aka “the moat”) and more recently in its advertising capabilities. The company is famous for solving internal problems first and then offering these same services to outside third parties to generate additional revenues. Think about Amazon Web Services or AWS – and how Amazon created it internally and oh by the way, essentially invented a new type of business based on selling cloud infrastructure. Amazon is in an enviable and unique position in that it can offer access to other businesses to leverage its logistics network and advertising solutions. Oh and the cherry on top? This also negatively impacts rivals such as Shopify and Google.  advertising solution that also owns transactional data (now almost three decades worth) that has been curated from customer product searches to customer purchases. This data in turn enables a compelling advertising engine for sellers and brands to efficiently and intuitively target Amazon’s most valuable customers, Prime members (now more than 200 million worldwide!).

advertising solution that also owns transactional data (now almost three decades worth) that has been curated from customer product searches to customer purchases. This data in turn enables a compelling advertising engine for sellers and brands to efficiently and intuitively target Amazon’s most valuable customers, Prime members (now more than 200 million worldwide!).

decide between discretionary spending and non-discretionary spending. Non-discretionary spending refers to items necessary for daily life – rent/mortgage, bills/utilities, groceries, etc. Examples of

decide between discretionary spending and non-discretionary spending. Non-discretionary spending refers to items necessary for daily life – rent/mortgage, bills/utilities, groceries, etc. Examples of  further away. However, you may see new emerging competitor brands selling the same items. Brand owners in this category will require strategy, innovation, and deeper analytics to drive profits on low-margin products. And as noted above, selling quantity packs or bundles will serve to increase the average order value. It’s also critical to have an awareness and understanding of how your margins may be impacted by logistics and marketing costs. Brands and sellers in this category MUST constantly factor in margin and profitability. A failure to thoroughly consider economics could result in flat loss-leaders and/or barely hitting break-even points.

further away. However, you may see new emerging competitor brands selling the same items. Brand owners in this category will require strategy, innovation, and deeper analytics to drive profits on low-margin products. And as noted above, selling quantity packs or bundles will serve to increase the average order value. It’s also critical to have an awareness and understanding of how your margins may be impacted by logistics and marketing costs. Brands and sellers in this category MUST constantly factor in margin and profitability. A failure to thoroughly consider economics could result in flat loss-leaders and/or barely hitting break-even points.

In the past decade, we have seen a new type of brand emerge from the e-commerce landscape. We’re talking about the growth of direct-to-consumer (DTC) brands (like Casper, Dollar Shave Club, Warby Parker, Glossier, etc.). Credit these brands for finding and filling product gaps thanks to a customer-

In the past decade, we have seen a new type of brand emerge from the e-commerce landscape. We’re talking about the growth of direct-to-consumer (DTC) brands (like Casper, Dollar Shave Club, Warby Parker, Glossier, etc.). Credit these brands for finding and filling product gaps thanks to a customer- Let’s begin by addressing the current chaos facing DTC brands.

Let’s begin by addressing the current chaos facing DTC brands. No surprise, but as marketplace-natives, these brands are familiar and comfortable with both the good and bad of Amazon. When these brands rely on that experience combined with Amazon’s legacy of innovations and their own scrappy presence, they’ll be positioned to grow their market share.

No surprise, but as marketplace-natives, these brands are familiar and comfortable with both the good and bad of Amazon. When these brands rely on that experience combined with Amazon’s legacy of innovations and their own scrappy presence, they’ll be positioned to grow their market share.

Costs of Logistics and Customer Acquisition: The Two-Headed Beast!

Costs of Logistics and Customer Acquisition: The Two-Headed Beast! By using familiar Amazon Prime logos and icons on DTC product detail pages and websites, brands, and sellers can quickly communicate a sense of trust to consumers who might be new to the brand and/or first-time visitors to the brand website. Buy with Prime also brings additional value and consumer confidence since it enables DTC brands a quick and recognizable payment and checkout option via

By using familiar Amazon Prime logos and icons on DTC product detail pages and websites, brands, and sellers can quickly communicate a sense of trust to consumers who might be new to the brand and/or first-time visitors to the brand website. Buy with Prime also brings additional value and consumer confidence since it enables DTC brands a quick and recognizable payment and checkout option via

WTF! Does it feel like you’re speaking a completely different language as an Amazon seller? One fact quickly becomes apparent as you embark as a merchant in the Amazon marketplace – there are dozens (check that,

WTF! Does it feel like you’re speaking a completely different language as an Amazon seller? One fact quickly becomes apparent as you embark as a merchant in the Amazon marketplace – there are dozens (check that,  AGS*

AGS*

An emerging and compelling opportunity is now available to those upstart ecommerce businesses and DTC brands. This option combines the best benefits of Amazon, but without the leap of faith to go “all in” with Amazon. Of course, we’re talking about the Buy with Program

An emerging and compelling opportunity is now available to those upstart ecommerce businesses and DTC brands. This option combines the best benefits of Amazon, but without the leap of faith to go “all in” with Amazon. Of course, we’re talking about the Buy with Program