Multi-Channel Fulfillment (MCF) costs are increasing – is Fulfillment by Amazon (FBA) next?

What will happen with 1P brands and vendors currently under negotiations with Amazon?

It’s almost the end of April 2023 and time for some reflection and honesty. Let’s face it, 2023 has been challenging so far. We’ve seen layoffs at most of the large incumbents (Amazon, Microsoft, Meta, Google, and others), inflation, while virtually all businesses are looking for cost savings at every customer touch point.

So what does this all mean for Amazon 3P sellers and 1P vendors? In the simplest terms, it means higher expenses and difficult negotiations. MCF has already seen a price increase and it’s likely it will be even more expensive as we approach Q4.

Amazon will no doubt use Prime Day to demand more deals from brands of all shapes and sizes and will likely also use the always-crazy fourth quarter as another inflection point to increase costs associated with shipping, warehouse space, etc.

Brands and vendors are almost certainly facing a year in which Amazon only gets more (and more) expensive.

What can you do to manage these costs?

Frequent readers of this blog know how much emphasis we place on brands possessing a thorough understanding of their unit economics. Use that data (again, at an ASIN level) to negotiate as hard as possible with Amazon to ensure you have some protective measures related to margins and profits.

Don’t despair!

Throwing your hands in the air if you just don’t care is simply enough. We get it.

Brands are in a tough position, is Amazon nothing more than a necessary evil? Hmmm, where else (besides Amazon) can you sell as many units, reach as massive of a purchasing audience, and generate as much revenue as you do today, selling via Amazon?

The answer is nowhere. Currently, no other platform as powerful as Amazon exists.

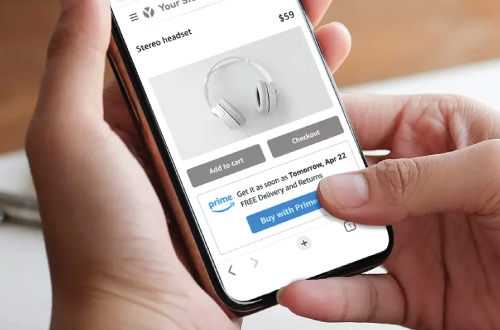

But fear not, we suggest using 2023 as the year in which you remove those non-performing ASINs from your Amazon account and begin to sell via other channels such as your Direct-to-consumer (DTC) website. If you’re smart, and we have faith in you, you should also leverage Buy with Prime (BwP) to reach as many of those 157 million plus Prime members.

Be strategic about the new products you add to the mix on Amazon. Does this product generate enough margin and profit for your business? If the answer is no – do not list it.

For lower-priced products (less than $50 per unit) bundle them together to grow your average order value (AOV). And in case you missed the memo, selling any item for less than $10/unit on Amazon is akin to throwing money away. Your order volumes would need to be MASSIVE to generate a profit.

In addition, our internal research has shown that in many cases sellers are competing against lower pricing from sellers from completely other markets, like those where sellers can survive with either smaller labor needs and/or pay for more staffing at lower costs.

Getting into an Amazon price war with these brands will not end well.

Do you have a “leaky” Amazon sales channel? Are you competing with a roster of unauthorized resellers selling your product on, or to Amazon? If so, talk to us about creating and implementing an authorized reseller program. Do it now!

Do you have a “leaky” Amazon sales channel? Are you competing with a roster of unauthorized resellers selling your product on, or to Amazon? If so, talk to us about creating and implementing an authorized reseller program. Do it now!

Have a plan! Ensure that you have an ironclad minimum advertised price (MAP) policy for your distributors and resellers. Also, ensure that your manufacturing partners are contractually prevented from reselling your products to, or on, Amazon. Competing against your own partners is a recipe for migraines and diminishing returns!

Bottomline: Brands/sellers should control as much of their brand and product Amazon ecosystem as possible! Accentuate the positive and do everything in your power to ensure that Amazon’s impending cost increases (winter is coming!) do not effectively kill your best-selling products or business.

We’d very much like to hear about your marketplace pain points and serve as your guide on this journey. Let’s get started – reach out to us today.

Welcome to Part 2. In the

Welcome to Part 2. In the  This requires nimble teams on the brand side that understand the need and often the urgency, for aggressive product pricing to move products out of facilities.

This requires nimble teams on the brand side that understand the need and often the urgency, for aggressive product pricing to move products out of facilities. A third storm element (and one with even bigger waves) creating challenges for sellers is the status of warehouse space at Amazon fulfillment centers for brands leveraging Fulfillment by Amazon (FBA). Running lean is the answer. In fact, if products are sold via FBA – the goal should be to turn that inventory before 60-90 days. The longer items remain in FBA warehouses, the larger the costs of storage in addition to sunk costs of business capital that cannot be accessed until the items are sold.

A third storm element (and one with even bigger waves) creating challenges for sellers is the status of warehouse space at Amazon fulfillment centers for brands leveraging Fulfillment by Amazon (FBA). Running lean is the answer. In fact, if products are sold via FBA – the goal should be to turn that inventory before 60-90 days. The longer items remain in FBA warehouses, the larger the costs of storage in addition to sunk costs of business capital that cannot be accessed until the items are sold.  If you feel the need for an experienced sailor – the team at

If you feel the need for an experienced sailor – the team at

apparent that Amazon wants to share (if not

apparent that Amazon wants to share (if not  building an online catalog and Bezos and team were able to quickly create

building an online catalog and Bezos and team were able to quickly create

No secrets here, but Amazon has invested heavily. First in its logistics and warehouse network (aka “the moat”) and more recently in its advertising capabilities. The company is famous for solving internal problems first and then offering these same services to outside third parties to generate additional revenues. Think about Amazon Web Services or AWS – and how Amazon created it internally and oh by the way, essentially invented a new type of business based on selling cloud infrastructure. Amazon is in an enviable and unique position in that it can offer access to other businesses to leverage its logistics network and advertising solutions. Oh and the cherry on top? This also negatively impacts rivals such as Shopify and Google.

No secrets here, but Amazon has invested heavily. First in its logistics and warehouse network (aka “the moat”) and more recently in its advertising capabilities. The company is famous for solving internal problems first and then offering these same services to outside third parties to generate additional revenues. Think about Amazon Web Services or AWS – and how Amazon created it internally and oh by the way, essentially invented a new type of business based on selling cloud infrastructure. Amazon is in an enviable and unique position in that it can offer access to other businesses to leverage its logistics network and advertising solutions. Oh and the cherry on top? This also negatively impacts rivals such as Shopify and Google.  advertising solution that also owns transactional data (now almost three decades worth) that has been curated from customer product searches to customer purchases. This data in turn enables a compelling advertising engine for sellers and brands to efficiently and intuitively target Amazon’s most valuable customers, Prime members (now more than 200 million worldwide!).

advertising solution that also owns transactional data (now almost three decades worth) that has been curated from customer product searches to customer purchases. This data in turn enables a compelling advertising engine for sellers and brands to efficiently and intuitively target Amazon’s most valuable customers, Prime members (now more than 200 million worldwide!).

In the past decade, we have seen a new type of brand emerge from the e-commerce landscape. We’re talking about the growth of direct-to-consumer (DTC) brands (like Casper, Dollar Shave Club, Warby Parker, Glossier, etc.). Credit these brands for finding and filling product gaps thanks to a customer-

In the past decade, we have seen a new type of brand emerge from the e-commerce landscape. We’re talking about the growth of direct-to-consumer (DTC) brands (like Casper, Dollar Shave Club, Warby Parker, Glossier, etc.). Credit these brands for finding and filling product gaps thanks to a customer- Let’s begin by addressing the current chaos facing DTC brands.

Let’s begin by addressing the current chaos facing DTC brands. No surprise, but as marketplace-natives, these brands are familiar and comfortable with both the good and bad of Amazon. When these brands rely on that experience combined with Amazon’s legacy of innovations and their own scrappy presence, they’ll be positioned to grow their market share.

No surprise, but as marketplace-natives, these brands are familiar and comfortable with both the good and bad of Amazon. When these brands rely on that experience combined with Amazon’s legacy of innovations and their own scrappy presence, they’ll be positioned to grow their market share.

Costs of Logistics and Customer Acquisition: The Two-Headed Beast!

Costs of Logistics and Customer Acquisition: The Two-Headed Beast! By using familiar Amazon Prime logos and icons on DTC product detail pages and websites, brands, and sellers can quickly communicate a sense of trust to consumers who might be new to the brand and/or first-time visitors to the brand website. Buy with Prime also brings additional value and consumer confidence since it enables DTC brands a quick and recognizable payment and checkout option via

By using familiar Amazon Prime logos and icons on DTC product detail pages and websites, brands, and sellers can quickly communicate a sense of trust to consumers who might be new to the brand and/or first-time visitors to the brand website. Buy with Prime also brings additional value and consumer confidence since it enables DTC brands a quick and recognizable payment and checkout option via

WTF! Does it feel like you’re speaking a completely different language as an Amazon seller? One fact quickly becomes apparent as you embark as a merchant in the Amazon marketplace – there are dozens (check that,

WTF! Does it feel like you’re speaking a completely different language as an Amazon seller? One fact quickly becomes apparent as you embark as a merchant in the Amazon marketplace – there are dozens (check that,  AGS*

AGS*